Media

We make the news for all the right reasons

If you’d like to follow our business, our growth and our key milestones, you’ve come

to the right page. These are all the reasons we make headlines regularly.

We make the news for all the right reasons

If you’d like to follow our business, our growth and our key milestones, you’ve come to the right page. These are all the reasons we make headlines regularly.

Trending

22 May 2025

How are NRIs looking at India as a long term investment destination? And, what are the other hot countries which they invest in?

NRIs are increasingly viewing India as a strategic long-term investment hub, driven by strong economic fundamentals, favourable demographics, and digital transformation.

According to the 2024 Knight Frank Wealth Report, over 65% of NRIs surveyed see India as a priority market for wealth allocation over the next decade. Key reasons include:

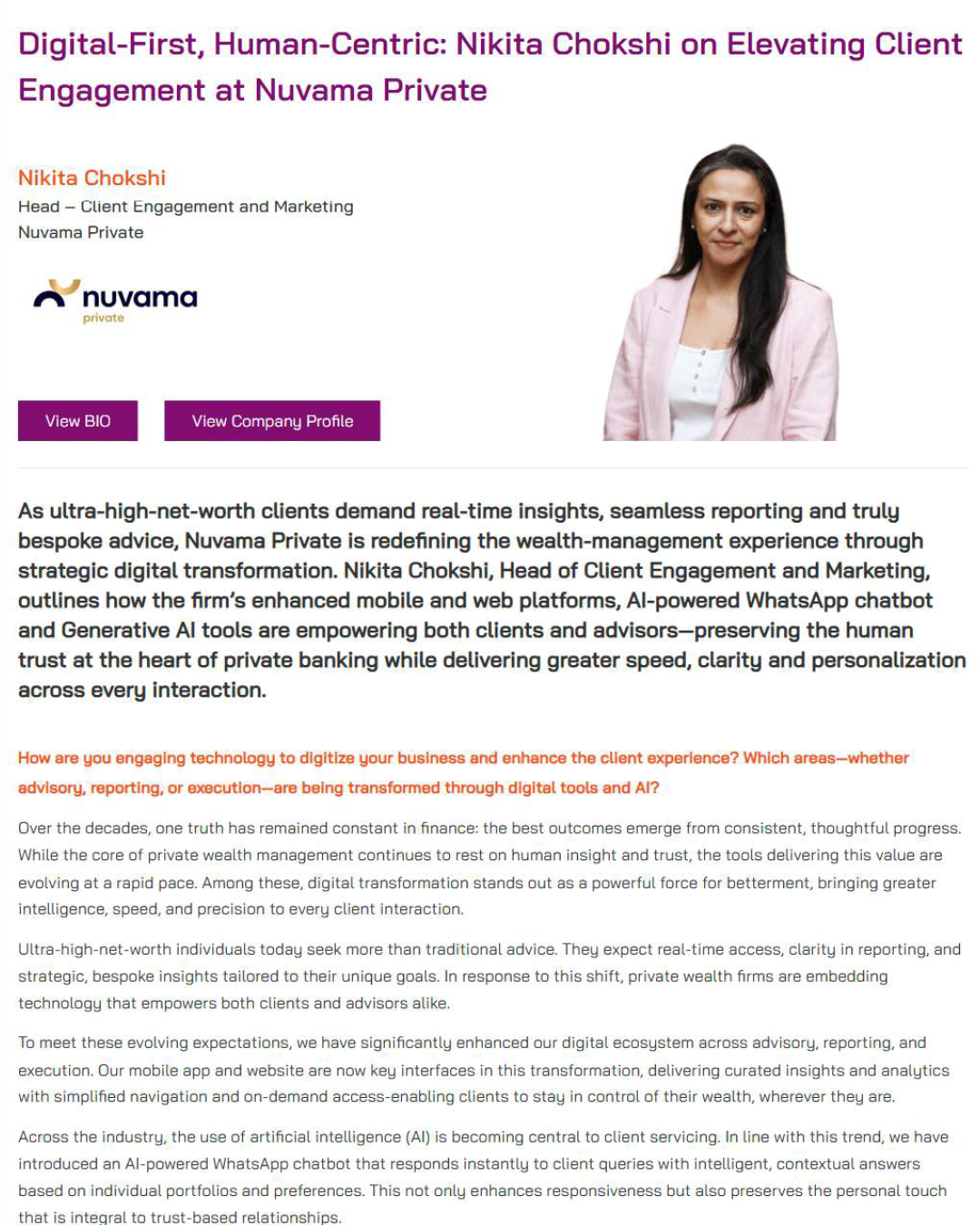

14 May 2025

How are you engaging technology to digitize your business and enhance the client experience? Which areas—whether advisory, reporting, or execution—are being transformed through digital tools and AI?

Over the decades, one truth has remained constant in finance: the best outcomes emerge from consistent, thoughtful progress. While the core of private wealth management continues to rest on human insight and trust, the tools delivering this value are evolving at a rapid pace. Among these, digital transformation stands out as a powerful force for betterment, bringing greater intelligence, speed, and precision to every client interaction.

07 May 2025

How Nuvama Private is Connecting Indian Wealth to Global Opportunity – and Global Capital to India

As Head of the International Business at Nuvama, Vivek Sharma is driving a pivotal chapter in the firm’s international expansion - bridging the needs of India’s globally dispersed wealthy with a cross-border platform that is fitfor-purpose, robust, and regulatory-compliant, while also opening the door wider to global investors seeking structured access to India’s fast-growing asset markets. In a recent interview with Hubbis, Sharma outlined how this strategy is being implemented through a phased rollout across major financial hubs - beginning in 2024 with Dubai and extending it to Singapore in 2025. Presence in these two locations, will enable Nuvama to cover both middle east and Asia as key hubs for the offshore business.

30 April 2025

What are the types of debt funds you position to the clients?

Debt allocation in a UHNI client portfolio can be broadly classified as ‘High Grade’ and ‘High Yield’. This allocation is deployed via bonds, NCDs, mutual funds, REITs/InvITs and AIFs. Mutual fund allocation is generally classified as ‘High Grade’ as typical debt funds being looked by UHNI clients are money market funds for short term allocation, corporate bond fund for medium term allocation and select Gilt funds for long term duration. For temporary parking, overnight, liquid and arbitrage funds continue to be preferred choices. It may be worthwhile to note that overall flows to debt mutual funds have moderated over last 2 quarters post changes in taxation for such funds.

16 February 2025

What are UHNW clients’ biggest

In addition to planning for succession, the two trends we have been seeing off late is geographical diversification of investments and obtaining residency by investment of a foreign country. With the changing times, the needs of the UHNIs are no longer plain and simple planning for succession. While that remains at the forefront, UHNIs are exploring setting up structures outside India to make investments in foreign markets. Also, with geographical diversification of assets and intending to have a Plan B for themselves, we have seen UHNIs exploring obtaining residency of a foreign country by making investments in that country with which they can travel hassle free any number of times in a year or settle in that country, if need arises. Some clients are also exploring getting citizenship of another country. Since India doesn’t allow dual citizenship, this trend is slow as compared to residency by investment abroad.

23 January 2025

2024 in Review: Insights from Nuvama Private’s Alok Saigal on India’s Private Wealth Management Transformation

As 2024 draws to a close, India’s private wealth management industry stands at the crossroads of significant evolution. Alok Saigal, President & Head Nuvama Private, reflects on a year marked by the rap expansion of wealth into Tier 2 and Tier 3 cities, a growing demand for offshore investments, and the rising complexity of client needs.

We’re covered by all major platforms

We’re covered by all major platforms