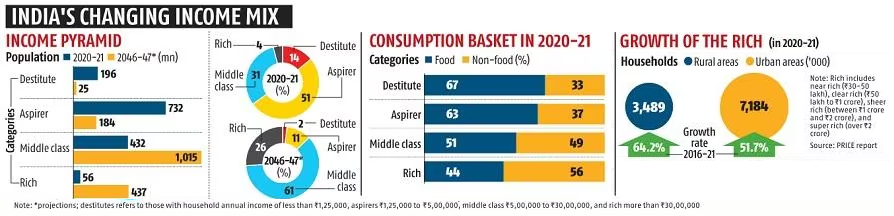

According to findings from the Pew Research Center, there is a notable surge in the size of India’s middle class. Projections indicate that by 2030, the number of individuals falling into the middle-class category in India will double, reaching an impressive 800 million people. The middle class, as defined by the PRICE report, consists of households with an annual income ranging from Rs 5-30 lakh.

| Year | Population (millions) |

|---|---|

| 1990 | 115 |

| 2000 | 200 |

| 2010 | 300 |

| 2020 | 540 |

| 2023 | 565 |

| 2030 | 800 |

| Year | Growth Rate (% per year) |

|---|---|

| 2000-2010 | 6% |

| 2010-2020 | 8% |

| 2020-2030 | 7% |

Source: PRICE Report

| Region | Middle class population (millions) |

|---|---|

| North India | 181 |

| South India | 125 |

| East India | 105 |

| West India | 129 |

Source: 2020-2021 PRICE Report

| State | Middle class population (millions) |

|---|---|

| Maharashtra | 74 |

| Tamil Nadu | 59 |

| Uttar Pradesh | 55 |

| Karnataka | 45 |

| Gujarat | 43 |

Source: 2020-2021 PRICE Report

The Significant Contribution of India’s Middle Class:

India is presently in the midst of a profound demographic shift, with a considerable segment of the population ascending to the middle class. This remarkable transformation is a rare event and holds substantial implications for India’s economic strength. Morgan Stanley, a renowned global financial services company, has underscored that the upcoming decade is poised for India’s ascent, recognizing the nation’s potential for unprecedented growth and prosperity.

In the year 2030, India’s economy is poised to undergo a significant transition, shifting from its predominant reliance on the bottom of the socio-economic pyramid to being primarily fueled by its rapidly growing middle class. This transformation will establish India as one of the world’s youngest nations, with expectations of hosting an astonishing population of over one billion internet users. Consequently, the emerging Indian consumer will have increased wealth and demonstrate a greater inclination to spend on a variety of products and services.

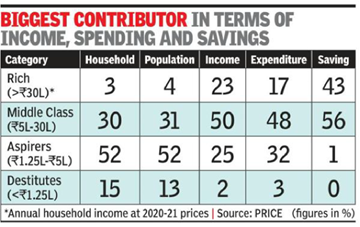

The Indian middle class is a powerful economic entity, accounting for roughly 50% of the total income earned, 48% of overall expenditures, and an impressive 56% of savings. This dynamic demographic constitutes about 31% of India’s total population, firmly establishing it as one of the most robust middle classes on the global stage.

Distribution of the middle class in India:

| Region | Number of Middle Class Households (‘000) |

|---|---|

| Urban | 47,978 (~4.7% Growth rate b/w 2015-16 to 2020-21 |

| Rural | 42,949 (~6.6% Growth rate b/w 2015-16 to 2020-21) |

The existing middle-class population stands at 432 million and is projected to reach nearly 800 million by 2030. Consequently, the present rural middle-class accounts for 288 million individuals, while the urban middle class comprises the remaining 144 million. Notably, Tier 2 and Tier 3 towns in India are witnessing a remarkable increase in the number of middle-income households, thereby reshaping the nation’s economic landscape.

Spending patterns of the middle class in India:

| Category | Share of spending (% of total) |

|---|---|

| Education | 20% |

| Healthcare | 15% |

| Consumer Goods | 55% |

| Others | 10% |

Source: Understanding the Burgeoning Indian Middle Class through its Expenditure and Asset-Ownership Patterns by Meghnad Desai Academy of Economics, 2020

National Council of Applied Economic Research (NCAER) Household Consumer Expenditure Survey, 2011-12

Expenditure on health, as a component of private final consumption expenditure, demonstrated a compound annual growth rate of 16.4%, whereas spending on education expanded at a rate of 16%.

Education: According to the report, the proportion of education expenditure increased from 3.6% in 2011-12 to 4.5% in 2018-19.

(Source: Business Standard)

Others Sources:

- People Research on India’s Consumer Economy (PRICE) report

- The Pew Research Center report “A Global Middle Class Is More Promise than Reality”.

- The World Economic Forum report “6 surprising facts about India’s exploding middle class”.

- The Indian government’s Ministry of Statistics and Programme Implementation website